Strengthen your defence

against fraud, increase revenue

Harness the power of technology to detect and block fraudulent transactions.

Our competitive edge

Early Prevention

Identify and prevent fraudulent activities early to prevent time-consuming interventions.

Automated Detection

Minimize fraud-related losses and save on operation costs with automated detection.

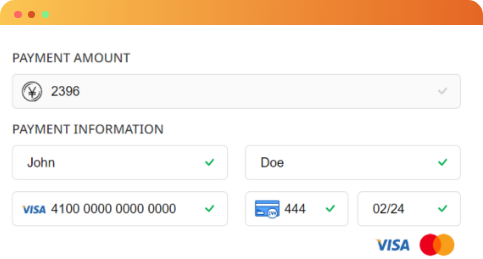

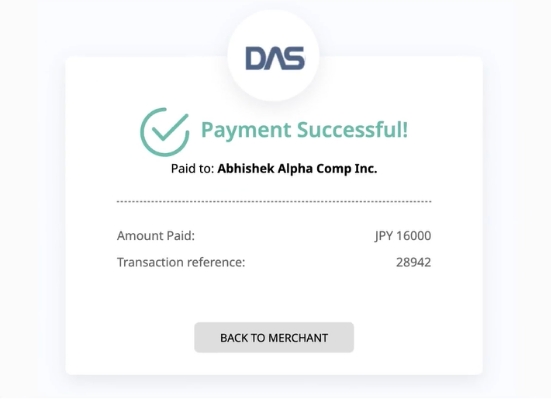

Accurate Approval

Accurately distinguish legitimate and fraudulent transactions to grant customers approval quickly.

Set your risk appetite

Every business has a different risk tolerance so we curate a fraud protection strategy that aligns with yours. We customise risk parameters, set transaction thresholds and implement rules that make sense for your business.

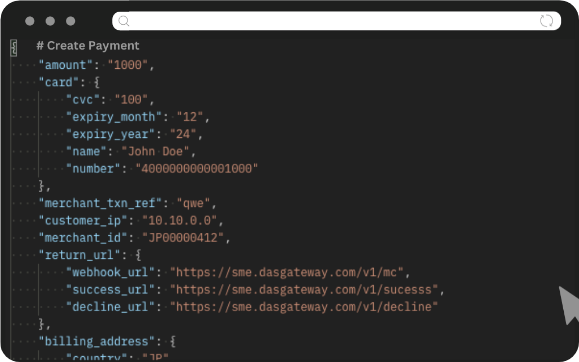

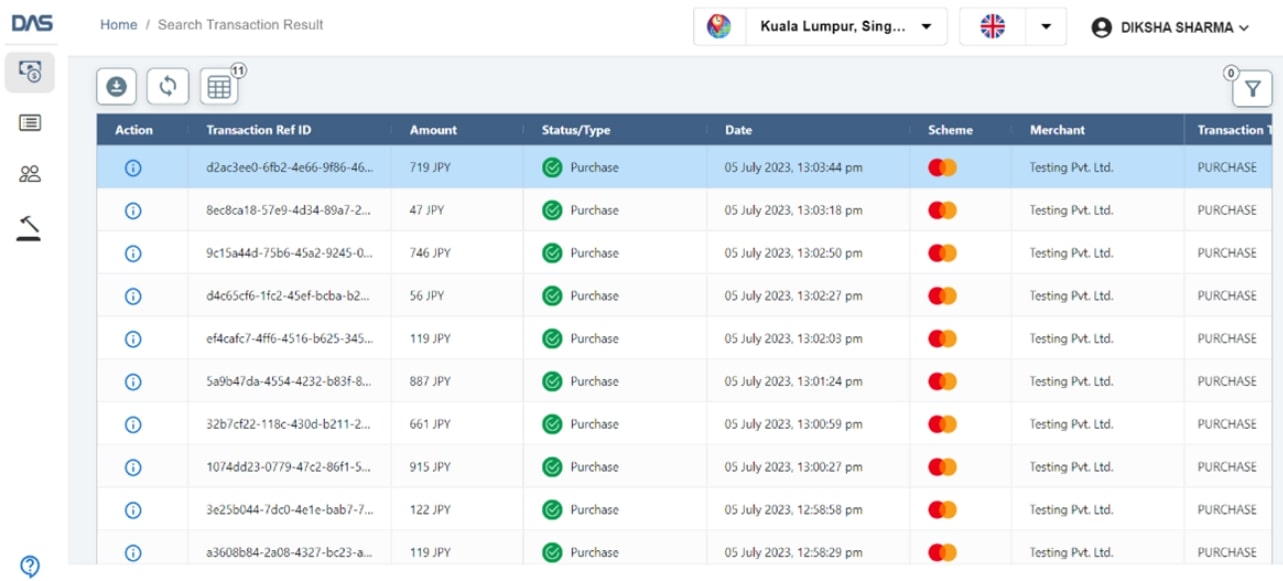

Detect and prevent fraud

With the power of robust databases, intelligent machine learning tools and technical expertise, our system sends signals to flag or block suspicious transactions.

Mitigate Fraud & Chargeback

Our system continuously monitors chargeback activity and provides real-time alerts when disputes arise. File for disputes and raise refunds quickly to protect you and your customers.

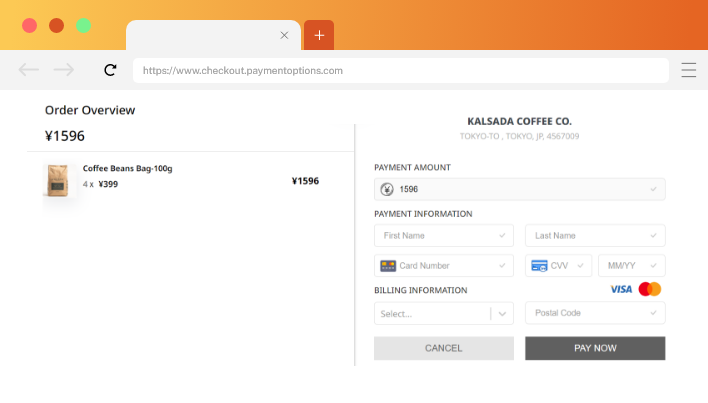

Maximise Transactions, Minimise Risk

Distinguish between legitimate and fraudulent transactions with our safeguards

-

AVS (Address Verification Service)

Verify the billing address of transactions against card issuer data to ensure legitimacy.

-

Blacklisted Cards

Identify and block risky transactions by cross-checking our comprehensive blacklist of known fraudulent cards.

-

CVV2

Reduce the risk of unauthorised card use by adding the CVV2 code as a requirement.

-

IP Blocking

Block suspicious or high-risk IP addresses to prevent fraudulent attempts.

-

Negative Database Scrubbing

Flag suspicious transactions in real-time through automated processes that detect known fraud techniques and patterns

-

Velocity Checks

Monitor the frequency and volume of transactions conducted by entities against predefined thresholds

-

3D Secure

Add an additional step for cardholder authentication to ensure secure and trusted payments.

Payment Data

Security & Tokenisation

-

PCI DSS Certified

We are committed to safeguarding payment data, implementing robust security measures and conducting regular audits to preserve the integrity of every transaction.

-

Tokenisation

By replacing sensitive cardholder data with unique tokens, we ensure that the original information is securely stored in our encrypted token vault. With tokenisation, enjoy a seamless payment experience, with enhanced security, reduced liability, and simplified compliance.